Who May Need Long Term Care Insurance?

Without a crystal ball, it’s difficult to predict exactly who will need long-term care or for how long they will need it. However, statistics can tell us who is generally at risk.

One study published in The New England Journal of Medicine (1991) noted: “Of the approximately 2.2 million persons who turned 65 in 1990, more than 900,000 (43%) are expected to enter a nursing home at least once before they die.” The same study reported that among people who live to age 65, about 1 in 4 will spend one year or more in a nursing home!

It’s been shown that as you grow older, your risk of needing nursing home care goes up. The likelihood of institutionalization is similar for men and women who live to advanced old age. About 62% of severely impaired women 85 and older are in a nursing home, as are 58% of severely impaired men in this age group.

Women are more likely to need nursing home care than men. The study discussed above projected that 13% of women will spend five or more years in a nursing home. Only 4% of men will be in a nursing home that long.

As you grow older, your risk of needing nursing home care also goes up.

If you already have health problems that are likely to mean you will need long-term care (for example, Alzheimer’s disease or Parkinson’s disease), you probably won’t be able to buy a policy. Insurance companies have medical underwriting standards to keep the cost of long-term care insurance affordable. Without such standards, most people would not buy coverage until they needed long-term care services.

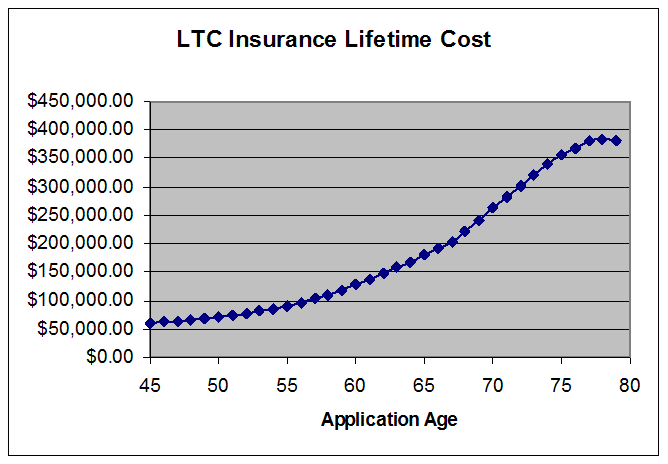

Many people think that they will save money spent on premiums if they just wait to buy long-term care insurance. This is absolutely untrue. The longer you wait, the more you will pay in premiums over your lifetime.

Each year you wait

- Increases the annual cost of the insurance because you have to buy a higher daily benefit due to the fact that the cost of long-term care has gone up.

- You are a year older so your premium will increase.

- You are at risk in the event you have a health change and cannot qualify for coverage.

Odds for using your coverage

- Home fire & damage

- Automobile damage & liability

- Medical Insurance

Long-term care

- 1 in 1200

- 1 in 250

- 1 in 15

- 2 in 5